In the ever-evolving landscape of technology and finance, few sectors have captured the imagination—and investment capital—as rapidly as 3D printing. This transformative technology, also known as additive manufacturing, has shifted from a niche industrial tool to a burgeoning market with profound implications for manufacturing, healthcare, aerospace, and beyond. Investors seeking to capitalize on this revolution increasingly turn to curated platforms like 5starsstocks.com, which offers focused analysis and guidance on 3D printing stocks.

This article explores the dynamic world of 3D printing stocks through the lens of 5starsstocks.com, illuminating key companies, market trends, challenges, and investment opportunities. As the additive manufacturing industry continues to mature, understanding the forces shaping it—and how to navigate them—is essential for investors seeking growth in a high-potential but volatile market.

Understanding 3D Printing: Technology and Market Overview

Before diving into stock analysis, it’s crucial to understand what 3D printing entails and why it is reshaping entire industries.

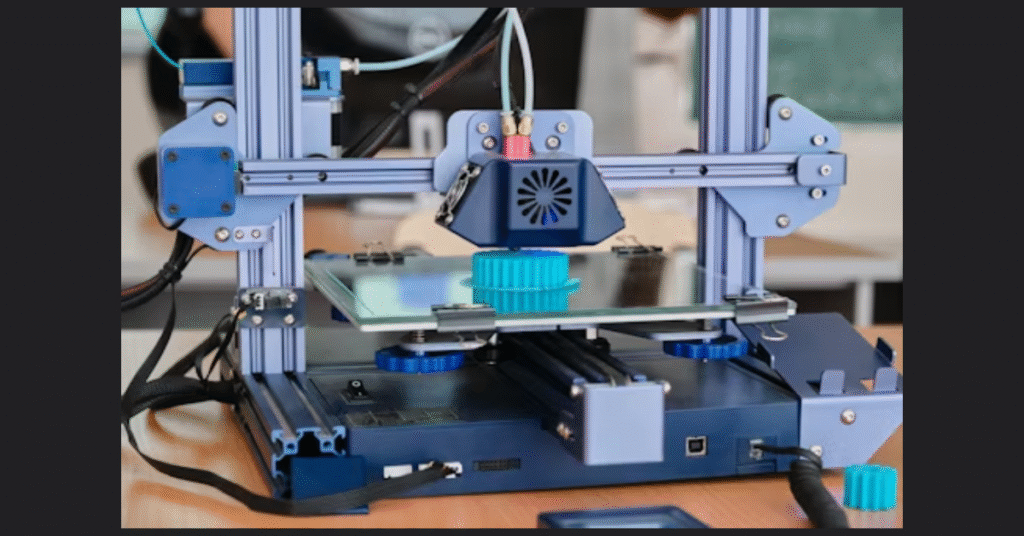

What Is 3D Printing?

3D printing is a process of creating three-dimensional objects by layering material based on digital designs. Unlike traditional subtractive manufacturing—which carves or cuts material away—additive manufacturing builds objects layer by layer, allowing for unprecedented design freedom, material efficiency, and customization.

Materials used in 3D printing include plastics, metals, ceramics, and even living cells, broadening applications from industrial parts to medical implants and consumer goods.

Industry Growth and Market Size

The global 3D printing market has expanded rapidly over the past decade, driven by advances in technology, decreasing costs, and increasing adoption in diverse sectors such as automotive, aerospace, healthcare, and consumer electronics.

Market analysts project continued double-digit growth over the coming years, fueled by innovations in materials, printer capabilities, and software. According to industry estimates, the 3D printing market could exceed $30 billion within the next five years, making it a fertile ground for investors.

5starsstocks.com: A Gateway to 3D Printing Stocks

For retail and professional investors alike, identifying promising 3D printing stocks amid a crowded market is a daunting task. This is where 5starsstocks.com comes in—a specialized investment platform offering stock picks, detailed research, and timely updates focused on high-growth sectors like 3D printing.

What is 5starsstocks.com?

5starsstocks.com is a financial information service that aggregates expert analysis, market news, and stock ratings to help investors uncover high-potential stocks. Their focus includes emerging technologies, with 3D printing being one of their featured categories due to its disruptive potential.

Subscribers gain access to stock reports, performance trackers, and forecasts that are tailored to guide investment decisions in 3D printing companies—from established giants to promising startups.

Why Trust 5starsstocks.com?

- Data-Driven Insights: The platform uses quantitative and qualitative data to assess company fundamentals, market position, and innovation pipelines.

- Expert Analysis: Contributors with backgrounds in finance, technology, and manufacturing provide nuanced perspectives.

- Timely Updates: The 3D printing market moves quickly, and 5starsstocks.com ensures users stay ahead with real-time news and stock movements.

- User-Friendly Interface: Designed for both beginners and seasoned investors, the platform offers accessible yet comprehensive tools.

Top 3D Printing Stocks Highlighted by 5starsstocks.com

Based on current market conditions and technological advancements, 5starsstocks.com identifies several key players that exemplify the promise and challenges of the 3D printing sector.

1. Stratasys Ltd. (NASDAQ: SSYS)

One of the pioneers in 3D printing technology, Stratasys has a broad portfolio of industrial and professional printers. The company excels in polymer 3D printing and offers solutions across aerospace, automotive, healthcare, and education sectors.

Investment Insight: Stratasys balances innovation with revenue growth. Its recent focus on materials science and manufacturing partnerships positions it well for continued expansion.

2. 3D Systems Corporation (NYSE: DDD)

3D Systems is another veteran in the field, known for its comprehensive product range—from printers to software and materials. Their advances in metal printing and healthcare applications, particularly in surgical guides and prosthetics, distinguish them.

Investment Insight: While facing competition, 3D Systems’ integrated ecosystem and growing service revenue offer stability and growth potential.

3. Materialise NV (NASDAQ: MTLS)

Materialise specializes in 3D printing software and services rather than hardware. Its role in providing digital manufacturing platforms and medical applications has garnered strong industry ties.

Investment Insight: Materialise’s SaaS model diversifies revenue streams and offers recurring income, an attractive quality for investors seeking resilience.

4. Desktop Metal, Inc. (NYSE: DM)

Focused on metal 3D printing, Desktop Metal is an innovator targeting the manufacturing and automotive sectors with affordable, high-speed solutions.

Investment Insight: Desktop Metal’s technological breakthroughs and partnerships with global manufacturers have sparked investor interest, though the company still navigates scaling challenges.

5. Voxeljet AG (NYSE: VJET)

Voxeljet specializes in large-scale industrial 3D printing, with clients in automotive, aerospace, and consumer goods.

Investment Insight: As demand for large and complex parts grows, Voxeljet’s niche expertise could translate into strong long-term gains.

Market Trends Influencing 3D Printing Stocks

Investors must consider broader market trends that impact 3D printing stocks’ valuations and growth prospects.

Technological Innovations

- Multi-Material Printing: The ability to print objects combining metals, plastics, and ceramics opens new applications.

- Speed and Scale: Advances in printer speed and build volume are critical for adoption in mass manufacturing.

- AI and Software: Integration of artificial intelligence improves design optimization, quality control, and production efficiency.

Industry Adoption

3D printing is moving beyond prototyping into full-scale production, especially in aerospace, automotive, and healthcare. Customized implants, lightweight vehicle parts, and on-demand manufacturing are becoming mainstream.

Supply Chain Resilience

Recent global supply chain disruptions have accelerated interest in localized manufacturing solutions—3D printing fits this trend perfectly by enabling on-site, just-in-time production.

ESG and Sustainability

Additive manufacturing’s potential to reduce waste and energy consumption aligns with environmental, social, and governance (ESG) priorities increasingly valued by investors.

Risks and Challenges Facing 3D Printing Stocks

While 3D printing promises disruption, it is not without risks that investors must weigh.

Market Competition

Numerous startups and established companies compete fiercely, driving rapid innovation but also price pressure.

Technology Maturity

Some segments of 3D printing remain in early stages, and widespread industrial adoption could be slower than expected.

Capital Intensity

R&D, manufacturing scale-up, and market education require significant capital investment, which can pressure cash flows.

Regulatory and Intellectual Property Concerns

Patents, certification standards (especially in medical applications), and export controls pose hurdles.

How 5starsstocks.com Helps Investors Navigate This Landscape

5starsstocks.com stands out as a vital tool for investors wanting to balance opportunity with risk in 3D printing stocks.

Comprehensive Stock Screening

The platform uses algorithmic screening to identify undervalued stocks with strong fundamentals and growth potential.

Market Sentiment Analysis

By tracking social media, news, and trading volume, 5starsstocks.com gauges investor sentiment to anticipate price movements.

Portfolio Recommendations

Subscribers receive curated lists balancing high-risk, high-reward stocks with more stable options, suited to individual risk tolerance.

Educational Resources

From webinars to detailed guides on 3D printing technology and market dynamics, 5starsstocks.com empowers investors with knowledge.

The Future Outlook: Why 3D Printing Stocks Matter

As industries embrace digital transformation, 3D printing’s role grows exponentially. It offers the promise of decentralized manufacturing, cost savings, and innovative product designs that were unimaginable just a decade ago.

Investors following 5starsstocks.com can position themselves to benefit from this evolution by tapping into emerging companies and established leaders poised for growth.

Moreover, as additive manufacturing technologies converge with AI, IoT, and advanced materials, the sector’s growth trajectory may accelerate, driving further market consolidation and new investment opportunities.

Conclusion: Seizing the 3D Printing Investment Opportunity with 5starsstocks.com

The 3D printing sector represents a captivating intersection of technology innovation and financial opportunity. Navigating this complex space requires keen insight, rigorous analysis, and access to timely information. Platforms like 5starsstocks.com serve as invaluable guides for investors seeking to harness the full potential of 3D printing stocks.

By focusing on proven companies and promising disruptors, while staying abreast of market trends and risks, investors can build portfolios that capitalize on the additive manufacturing revolution. As 3D printing technologies mature and penetrate new industries, the stocks highlighted by 5starsstocks.com may well become the blue chips of tomorrow’s industrial landscape.

FAQs About 5starsstocks.com and 3D Printing Stocks

1. What makes 5starsstocks.com a reliable source for 3D printing stock information?

5starsstocks.com combines expert analysis, data-driven insights, and real-time updates tailored to emerging tech sectors like 3D printing.

2. Are 3D printing stocks a good investment right now?

They offer high growth potential but come with volatility and risks; diversified portfolios and informed research are crucial.

3. How does 3D printing technology impact traditional manufacturing sectors?

It enables faster prototyping, customized production, reduced waste, and potential reshoring of manufacturing activities.

4. Can I invest in 3D printing without buying individual stocks?

Yes, ETFs and mutual funds focused on additive manufacturing exist, but individual stock analysis via platforms like 5starsstocks.com can offer targeted opportunities.

5. What are the key challenges for 3D printing companies?

Market competition, technology adoption rates, regulatory hurdles, and capital requirements are main challenges impacting profitability.