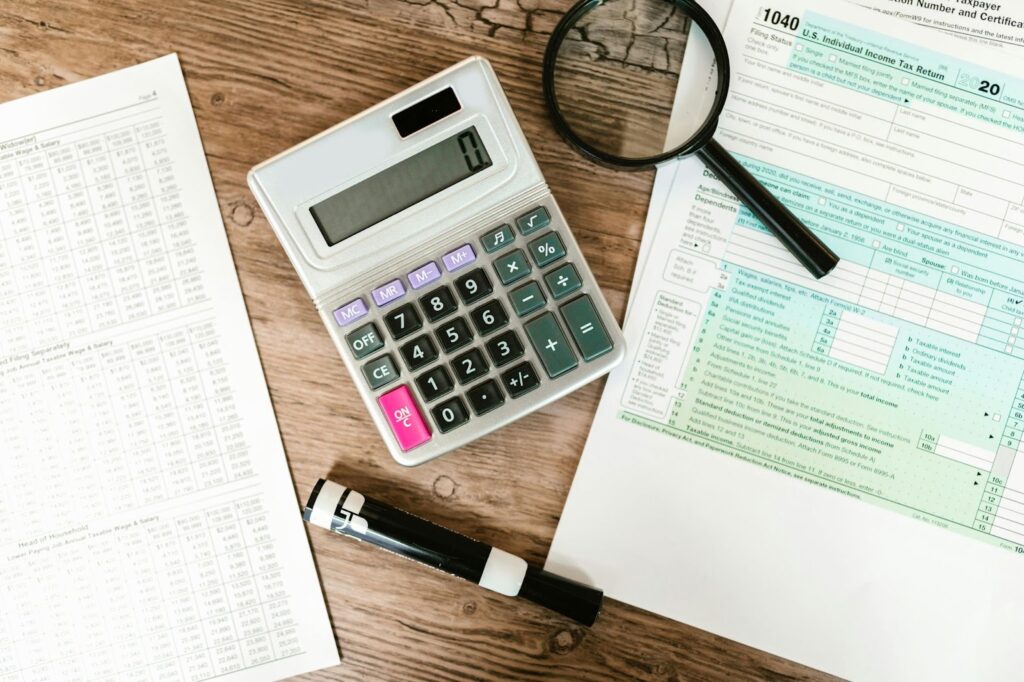

Ready to tackle rental applications confidently? Understanding the key documents needed to prove your income is vital. Landlords require these to gauge your financial stability and ensure you can afford rent.

From pay stubs to tax returns, these papers paint a clear picture of your earnings. Being proactive in gathering these documents boosts your approval chances and simplifies the rental process.

Stay prepared, showcase your financial strength, and set a solid foundation for a transparent landlord-tenant relationship.

Required Documents for Employed Individuals

What is proof of income? When proving your income as an employed individual, you’ll typically need to provide pay stubs as a common method for verification. These proof of income documents contain essential details such as your income, deductions, name, and address. They can demonstrate income consistency and even bonuses or commissions.

While not federally required, pay stubs are often requested by landlords as proof of income for apartment rentals. In addition to pay stubs, other documents like W-2 forms, tax returns, and income letters from your employer can also serve as crucial proof of income.

Ensuring you have these documents in order can streamline the rental application process and increase your chances of securing the apartment you desire.

Essential Documents for Self-Employed Individuals

To seamlessly transition from proving income as an employed individual to self-employment verification, ensure you have essential documents like profit and loss statements readily available.

What’s proof of income when you’re self-employed? Profit and loss statements outline your business’s financial performance over a specific period, demonstrating your income, expenses, and ultimately, your net profit. These statements are crucial for showcasing your earning capabilities and financial stability as a self-employed individual.

Additionally, tax returns, invoices, and bank statements can further support your income claims. Having these documents organized and up to date will streamline the process of proving your income as a self-employed individual when required for various purposes like renting a property or applying for a loan.

Additional Documents for Rental Applications

As a self-employed individual transitioning to proving income for rental applications, ensuring you have essential documents like profit and loss statements readily available is crucial. Apart from the standard proof of income documents, additional paperwork may be required by some landlords to assess your financial stability. These might include bank statements, tax returns for the past few years, and references from previous landlords to demonstrate your reliability as a tenant.

Providing these supplementary documents strengthens your rental application and increases the likelihood of securing the desired property. Being proactive in gathering all necessary paperwork not only expedites the rental process but also showcases your responsibility and preparedness as a potential tenant.

Consequences of Missing Proof of Income

If you fail to provide the necessary proof of income, you risk facing application rejection and potential delays in the rental process. Landlords rely on this information to assess your financial stability and ability to pay rent on time. Without proof of income, they may doubt your capacity to fulfill your lease obligations, leading to rejection or requests for a co-signer.

Missing documentation could limit your rental options and might even result in a requirement for a higher security deposit. Promptly providing the required proof of income is crucial for a smooth and efficient rental experience, as it demonstrates your financial capability and builds trust with the landlord, increasing your chances of approval.

Importance of Co-Signers or Guarantors

When considering rental applications, having a co-signer or guarantor can significantly enhance your chances of approval. A co-signer acts as a backup plan for landlords, reassuring them that the rent will be paid even if you face financial difficulties. This added layer of security can make landlords more willing to approve your application, especially if your income doesn’t meet the required threshold.

Guarantors, often family members or close friends, offer their financial stability to support your tenancy. Their involvement indicates to the landlord that there’s someone else willing to take responsibility if needed.

Conclusion

So, now that you have a clear understanding of the most commonly requested documents for proving your income when applying for a rental, you can approach the process with confidence.

By being proactive and organized in gathering these essential documents, you can demonstrate your financial stability to landlords and increase your chances of approval.

Remember, transparency and trust are key in establishing a successful landlord-tenant relationship.

Good luck with your rental application process!